The Advantages of Medicare: Ensuring Affordable Health Care for All

In a world where access to budget friendly healthcare remains a pressing issue, Medicare arises as a beacon of expect countless individuals. The advantages of this detailed medical care program are manifold, offering a range of advantages that guarantee the wellness of its beneficiaries. From its detailed insurance coverage to its vast network of suppliers, Medicare stands as an essential lifeline for those looking for budget-friendly medical care. That's not all; there is a lot even more to discover about this indispensable program - a program that continues to transform lives and redefine the really idea of obtainable medical care.

Comprehensive Protection

Comprehensive coverage under Medicare offers extensive advantages and makes sure that people have accessibility to a wide variety of needed medical care solutions. Medicare, a federal wellness insurance program largely for individuals matured 65 and older, gives protection for medical facility remains, doctor visits, prescription medications, preventive solutions, and a lot more. This extensive insurance coverage is created to supply monetary security and peace of mind to Medicare recipients, enabling them to obtain the care they need without encountering outrageous out-of-pocket expenses.

One of the crucial benefits of comprehensive protection under Medicare is the gain access to it supplies to a vast range of health care services. Medicare beneficiaries have the liberty to pick their doctor, including physicians, experts, health centers, and other healthcare facilities, offering them the flexibility to receive treatment from relied on specialists. This ensures that people can get the needed clinical therapy and services, consisting of preventative treatment, diagnostic tests, surgical treatments, and continuous care for chronic conditions.

Moreover, Medicare's extensive protection includes prescription medicine advantages. This is specifically substantial as several elders count on drugs to handle their health and wellness conditions - Best Medicare plan Massapequa. With Medicare, recipients have access to a formulary of covered prescription medications, which helps to lower the financial burden of purchasing drugs. This extensive protection allows people to gain access to required drugs without sacrificing their monetary security.

Cost-Sharing Options

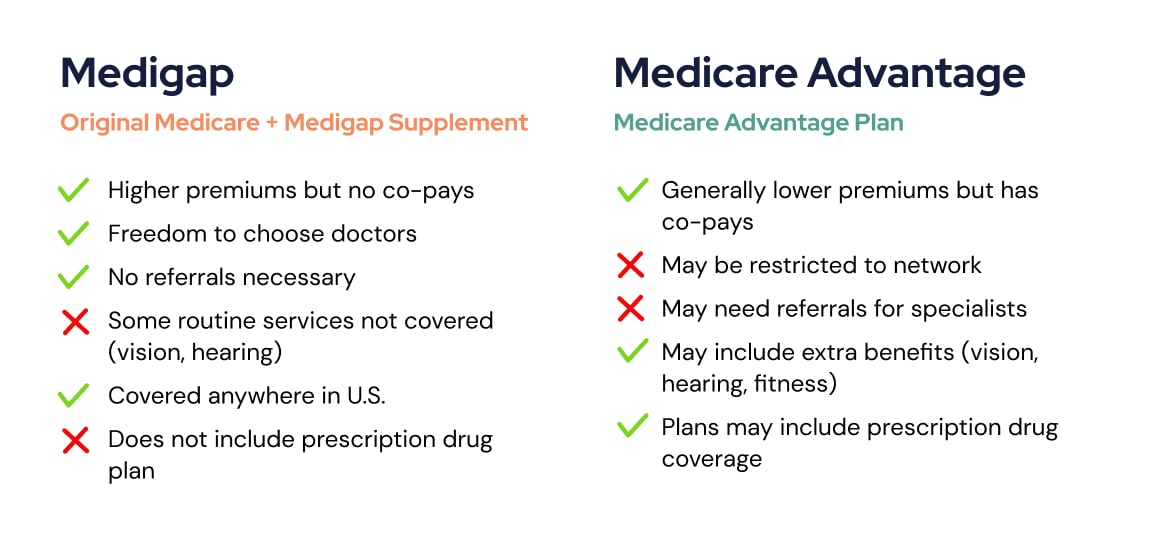

In addition, Medicare supplies the alternative of acquiring supplemental insurance, recognized as Medigap, to help cover the costs that original Medicare does not pay for. An additional cost-sharing option is the Medicare Component D prescription medication protection, which helps beneficiaries manage their essential medications. Overall, these cost-sharing alternatives play an important function in making certain that Medicare recipients can access the healthcare they need without facing frustrating monetary burdens.

Wide Network of Providers

A crucial advantage of Medicare is its extensive network of medical care service providers. Medicare is a federal medical insurance program that supplies insurance coverage to individuals aged 65 and older, in addition to specific more youthful individuals with impairments. With over 1.4 million healthcare service providers joining Medicare, beneficiaries have accessibility to a large range of physician, health centers, and centers throughout the nation.

Having a large network of companies is essential in ensuring that Medicare beneficiaries have accessibility to the healthcare solutions they need. With Medicare, people have the freedom to select their health care service providers, providing the flexibility to seek care from medical professionals and experts that best meet their needs.

Medicare's network of service providers includes medical care medical professionals, specialists, healthcare facilities, nursing homes, and home health and wellness companies. This wide variety of providers makes sure that beneficiaries can receive detailed and worked with care, from regular check-ups to specialized therapies.

Moreover, Medicare's network likewise consists of companies who approve project, implying they accept approve Medicare's accepted quantity as repayment completely for covered services. This assists to keep costs down for beneficiaries and makes sure that they are not left with extreme out-of-pocket costs.

Prescription Medicine Protection

Prescription drug insurance coverage is a crucial part of medical care for lots of people, making certain access to essential medications and advertising total wellness. Medicare, the government wellness insurance coverage program for people matured 65 and older, supplies prescription medicine insurance coverage with the Medicare Component D program. This coverage helps beneficiaries manage the price of prescription medications, which can usually be costly.

In Addition, Medicare special info Component D plans commonly negotiate discounted prices with pharmaceutical makers. These negotiated prices assist lower the out-of-pocket prices for beneficiaries, making medications extra accessible and economical. The program also includes a devastating protection arrangement, which assists safeguard recipients from high medication prices by restricting their annual out-of-pocket expenditures.

Preventive Services

Advertising total well-being, Medicare Component D likewise supplies coverage for a range of preventive solutions that assist people preserve their health and wellness and detect potential concerns early. Medicare recognizes the importance of preventive treatment in decreasing healthcare expenses and enhancing total health and wellness end results.

Under Medicare Component D, recipients have access to a variety of preventive services, such as screenings, inoculations, and counseling. These services are developed to stop or detect health and wellness problems at a beginning when treatment is much more effective and less pricey. Examples of precautionary services covered under Medicare Part D consist of mammograms, colonoscopies, flu shots, and smoking cigarettes cessation counseling.

Additionally, precautionary services can additionally help people make informed choices about their wellness. With counseling and education and learning, recipients can find out regarding healthy and balanced lifestyle choices, condition avoidance techniques, and the importance of normal examinations. This empowers individuals to take control of their health and wellness and choose that favorably impact their health.

Verdict

Finally, Medicare provides extensive coverage, cost-sharing alternatives, a vast network of suppliers, prescription medicine protection, and preventive solutions. These advantages guarantee that economical medical care comes to all people. The program plays an essential role in advertising the well-being and lifestyle for the elderly, impaired, and low-income populaces. By eliminating individual pronouns, an extra academic and objective design of writing is attained.

Comprehensive protection under Medicare guarantees and supplies extensive benefits that individuals have accessibility to a broad variety of essential healthcare solutions - Medicare advantage agent in massapequa.One of the essential advantages of detailed insurance coverage under Medicare is the accessibility it gives to a vast array of check my reference healthcare services. Furthermore, Medicare provides the option of purchasing supplemental insurance coverage, understood as Medigap, to assist cover the expenses that initial Medicare does not pay for. Medicare, the government health and wellness insurance coverage program for individuals aged 65 and older, offers prescription drug coverage through geico office near me the Medicare Part D program.In conclusion, Medicare supplies detailed protection, cost-sharing options, a vast network of carriers, prescription medication protection, and preventive services